A Company That Has Issued Cumulative Preferred Stock

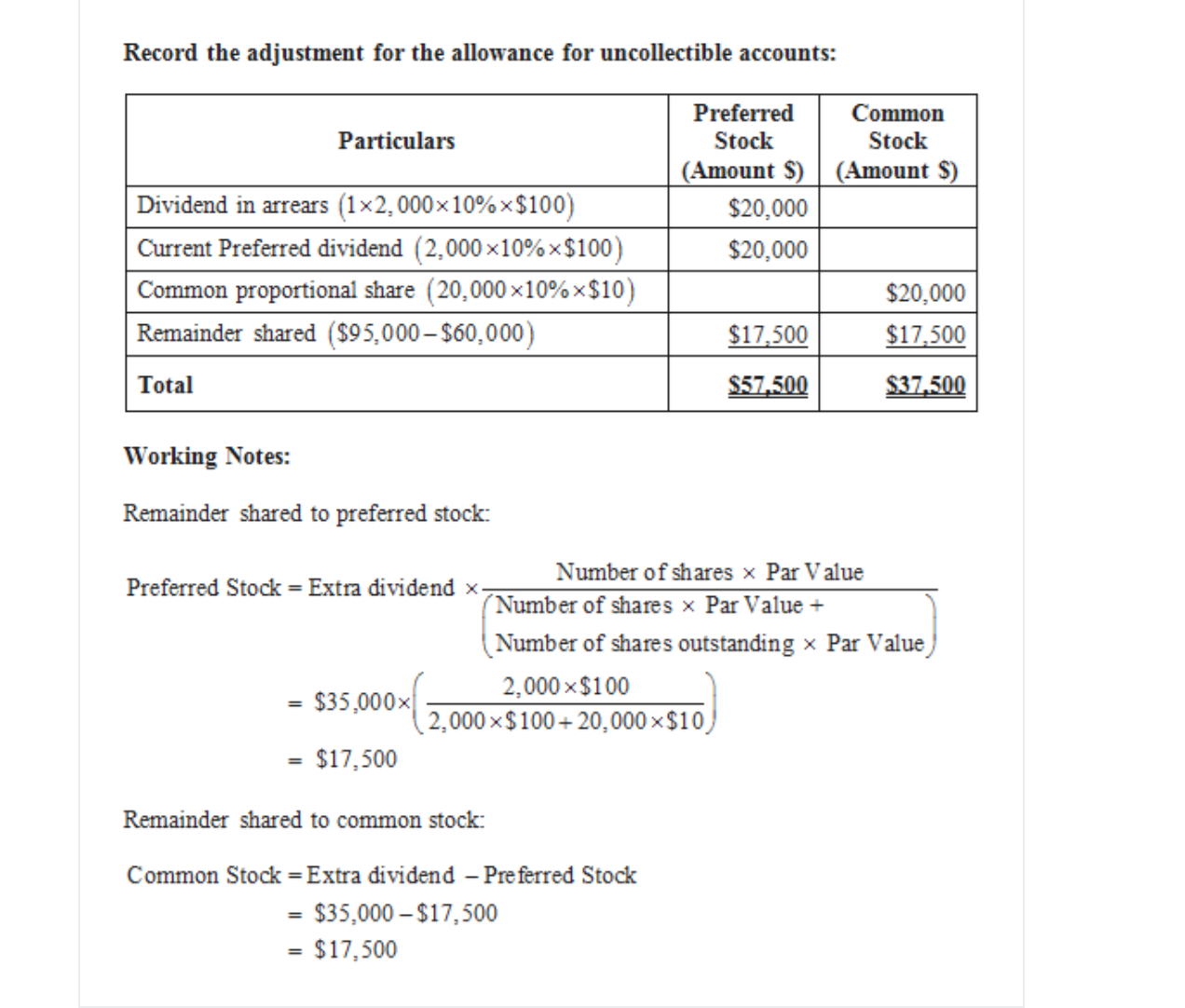

Answer to The Chester Company has issued 10 nonparticipating cumulative preferred stock with a total par value of 400000 and common stock with a total par value of. Macy Company has 10000 shares of 2 cumulative preferred stock of 50 par and 25000 shares of 75 par common stock.

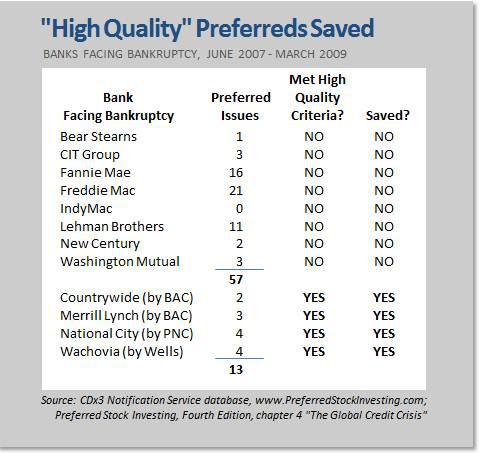

Cumulative Preferred Stock Dividend Characteristic Saves Citizens Republic Shareholders Nasdaq Crbc Seeking Alpha

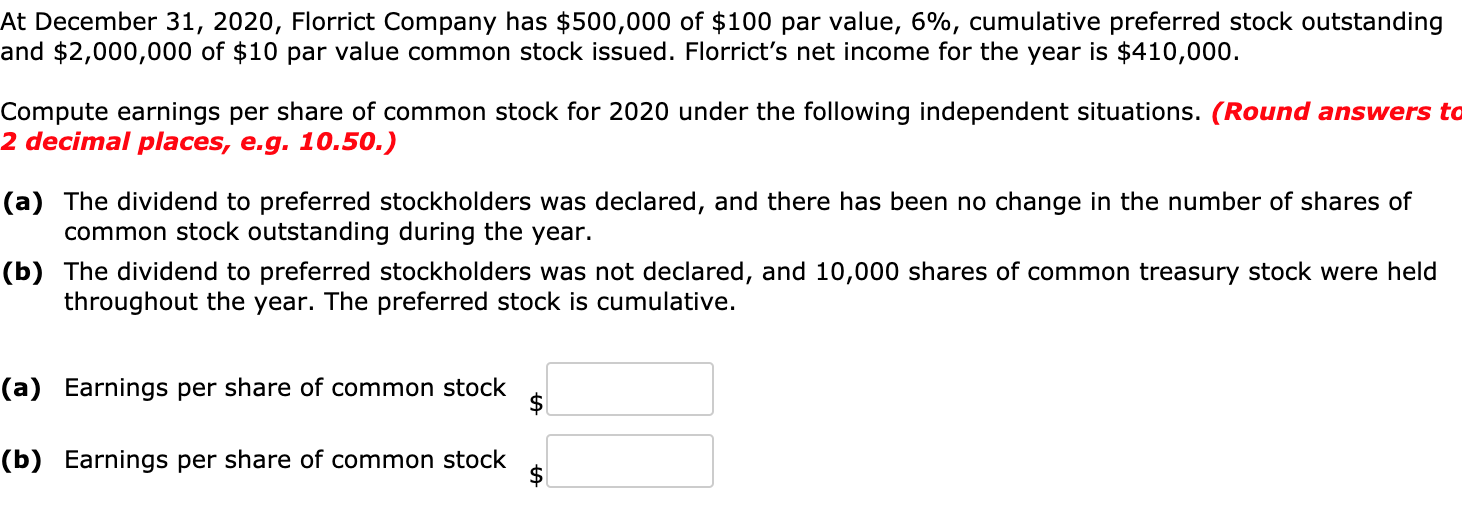

Business Accounting QA Library Chicago Company reported the following information at the end of the current year.

. No dividends are in arrears. The frank company has issued 10 fully participating cumulative preferred stock with a total par value of 300000 and common stock with a total par value of 900000. Although not a liability the amount of any dividends in arrears must be disclosed in the.

Currently the preferred stock is trading at 102 while the common stock is trading at 7550. Common stock 10 par value. How much cash will be paid to the preferred stockholders and the common stockholders respectively if cash dividends of 180000 are distributeda 80000 to preferred and.

If a company has issued cumulative preferred stock and does not declare a dividend the company has dividends in arrears. American Equity Investment Life Holding ADRs of. A company that has issued cumulative preferred stock.

A corporation has issued 100 par 8 cumulative convertible preferred stock callable at par. This is in addition to preferred dividends. How much cash will be paid to the preferred stockholders and the common stockholders respectively if cash dividends of 222000 are distributed at the.

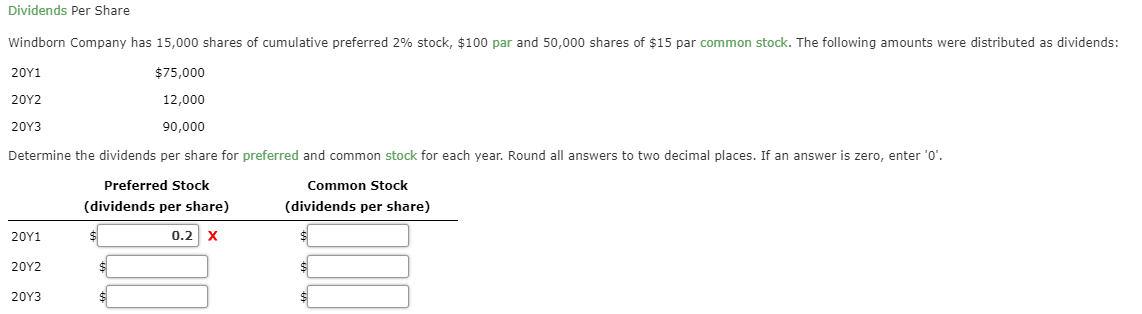

Year 1 75000Year 2 24000 Year 3 90000 Determine the dividends per share forpreferred and common stock for each year. The Chester Company has issued 10 nonparticipating cumulative preferred stock with a total par value of 400000 and common stock with a total par value of 800000. If preferred stock is designated as cumulative the suspended dividends accumulate and you must later pay them in full.

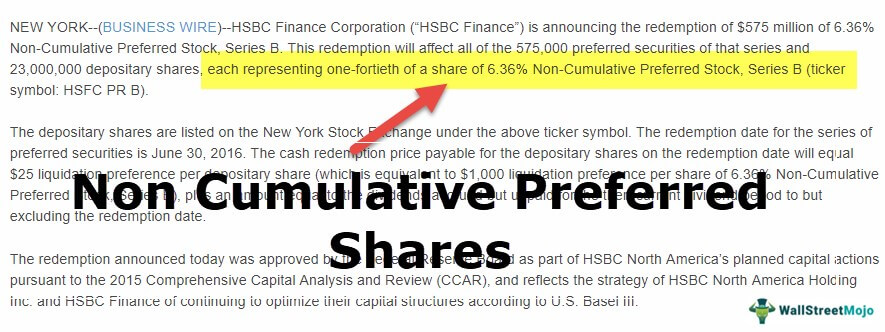

A corporation has issued 100 par 8 cumulative convertible preferred stock callable at par. This means that shareholders do not have a claim on any of the dividends that were not paid out. Year 130000 Year 26000 Year 380000 Determine the dividends per share for preferred and common stock for each year.

The following amounts were distributed as dividends. The corporation calls the preferred stock at par plus accrued dividends of 2 per share. The preferred is convertible into 14 shares of common stock.

In case of cumulative preferred stock dividends to common stock holders cant be paid until preferred dividends for the current and. Cumulative Preferred Stocks are a type of preferred stock that abides the company to pay all the dividends for this type of shareholders before paying any other shareholder of the company. If the company announces a common dividend in the following year how much does it owe preferred stockholders.

Once the notice of call has been. The corporation calls the preferred stock at par plus accrued dividends of 2 per share. Dividends for one previous year are in arrears.

In the first 2 years it paid 4 and 5 in dividends respectively. No dividends have been paid by the company since May 31 Year 4. Thefollowing amounts were distributed as dividends.

Up to 256 cash back Seacrest Company has 20000 shares of cumulative preferred 1stock 150 par and 50000 shares of 20 par common stock. This means that the company is supposed to pay all the dividends including the ones that were previously not paid out to these cumulative preferred shareholders. Wilton Corporation has 5000 shares of 6 cumulative 100 par value preferred stock outstanding and 175000 shares of common stock outstanding.

Noncumulative preferred stock allows the issuing company to skip dividends and cancel the companys obligation to eventually pay those dividends. The preferred is convertible into 14 shares of common stock. A company has previously issued 8 100 par cumulative preferred stock.

8200 shares outstanding 82000 Retained earnings 282000 The board of directors is considering the distribution of a cash dividend to the two. Usually the issuing company cannot issue dividends to the holders of its common stock in the same year. Having cumulative preferred stock simply reinforces the preference preferred stockholders receive when a dividend is declared.

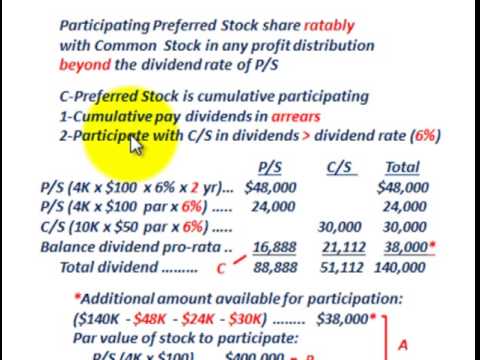

No dividends are in arrears. Cumulative preferred stock refers to shares that have a provision stating that if any dividends have been missed in the past they must. A participating feature gives preferred shareholders the right to receive a share of dividends paid to common shareholders.

Where the profit is not enough to cover the annual preferred stock pay-off some preferred stock may have a provision to recover the dividends not paid in future periods such preferred stock is called cumulative preferred stock. How much cash will be paid to the preferred stockholders and the common stockholders respectively if cash dividends of 180000 are distributed. B forces conversion of the preferred that is trading at a discount to par thereby eliminating the need to pay past-due dividends.

Currently the preferred stock is trading at 102 while the common stock is trading at 7550. A pays past and current preferred dividends before paying dividends on common stock. The Chester Company has issued 10 nonparticipating cumulative preferred stock with a total par value of 400000 and common stock with a total par value of 800000.

37000 shares outstanding 370000 Preferred stock 10 10 par value. 575 rows List of US.

Difference Between Cumulative And Non Cumulative Preferred Stocks With Table Ask Any Difference

Preferred Shares Meaning Examples Top 6 Types

Non Cumulative Preference Shares Stock Top Examples Advantages

Solved At December 31 2020 Florrict Company Has 500 000 Chegg Com

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Answered A Corporation S Shareholders Are Not Bartleby

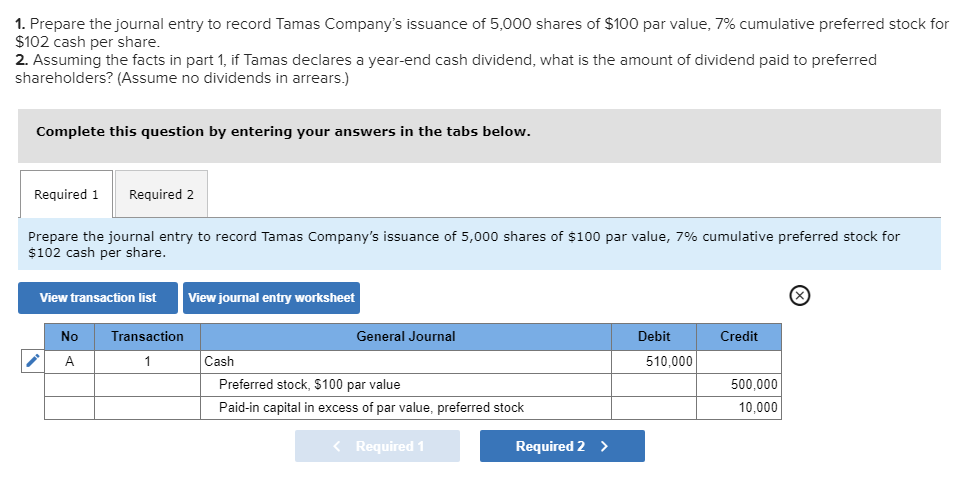

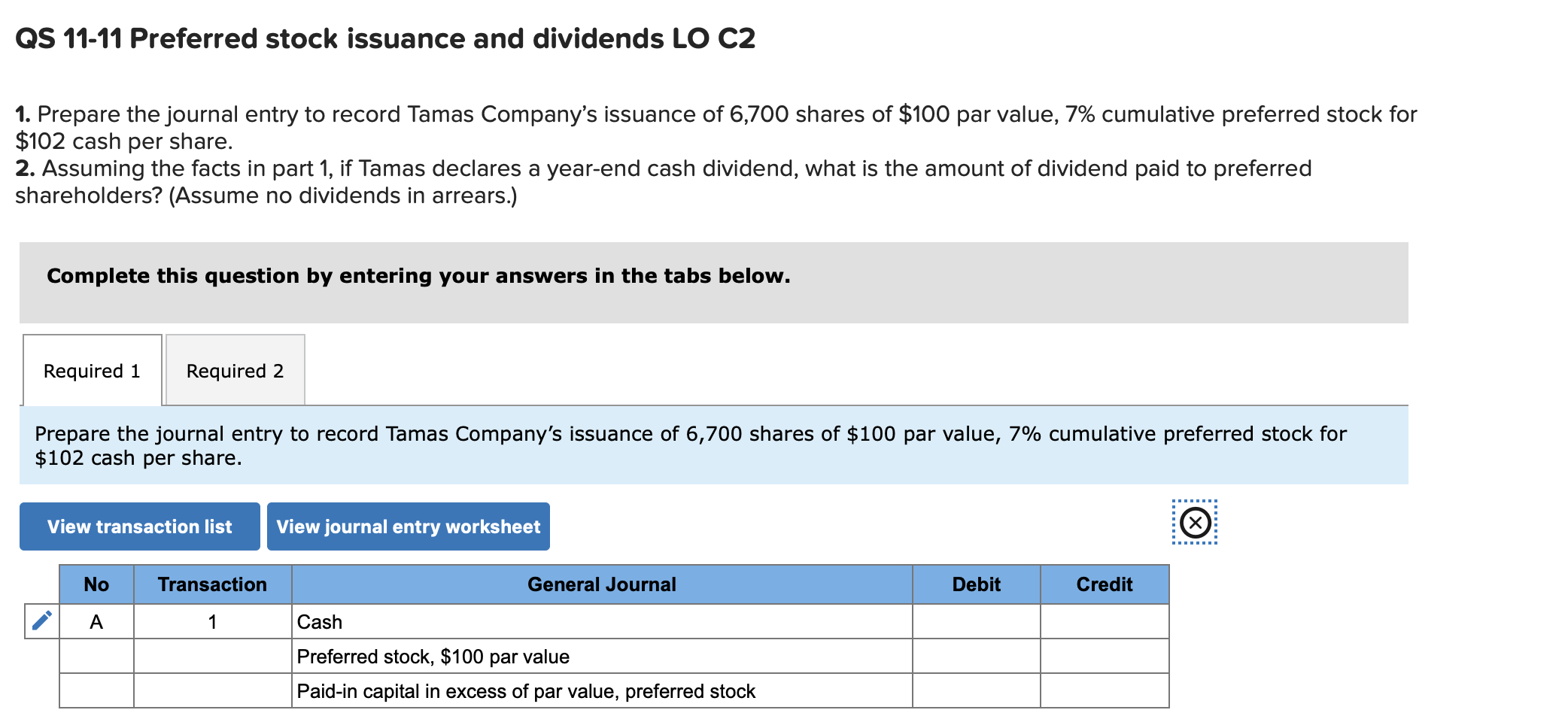

Solved 1 Prepare The Journal Entry To Record Tamas Chegg Com

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Corporations Organizations And Capital Stock Ppt Download

Let S View Complete Details About Preference Shares Preferences How To Find Out Let It Be

American Telephone And Telegraph Company Telephone Business Rules Dow Jones Index

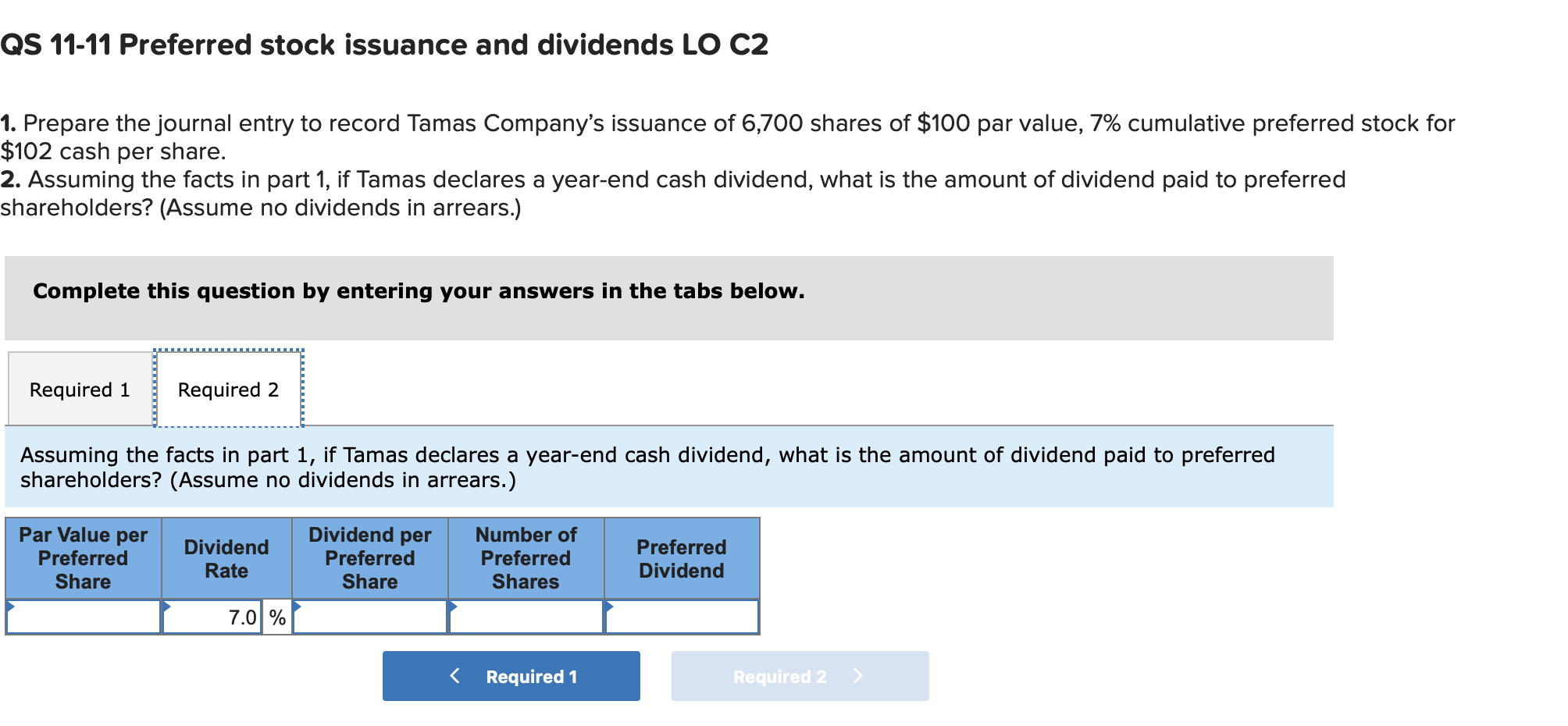

Solved Qs 11 11 Preferred Stock Issuance And Dividends Lo C2 Chegg Com

Acct101 Ch 11 Example Exercise Flashcards Quizlet

Pin On Stocks And Shares Ephemera Mad On Collections

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Types Of Preference Shares Accounting Principles Learn Accounting Financial Literacy Lessons

Solved Dividends Per Share Windborn Company Has 15 000 Chegg Com

Cumulative Preferred Stock Definition

Solved Qs 11 11 Preferred Stock Issuance And Dividends Lo C2 Chegg Com

Comments

Post a Comment